Do you ever dream of winning big at the casino? While the odds are slim, it is possible to win a million dollars or more if luck is on your side. But what happens when you do? What are the disbursement options and tax implications that come with such a large sum of money? In this article, we will explore all these questions in detail so you can be prepared for any potential windfall. We’ll look at how much money can be cashed out without taxes, how the IRS finds out if you gambled, how much can be won without claiming, who is the richest gambler in history and more!

So keep reading to find out what could happen if you hit that lucky jackpot

When it comes to winning a million dollars at the casino, there are several aspects to consider. You need to decide if you want your winnings all at once or in payments. It depends on the game you played and the laws where you won. You might only be able to get your winnings all at once. Also, casino winnings are taxed as income, so your taxes might go up if you cash out.

How to Cash Out at a Casino without Paying Taxes

It is possible to cash out large sums of money from the casino without paying taxes. Generally, you have up to 90 days to decide whether you would like a lump sum or annuity, though this may vary depending on where you are playing. In some cases, only a lump sum is offered and there is no disbursement option.

However, with careful planning and assistance from tax professionals, you can structure your lump sum payout in a way that gives you the best chance to keep more of your winnings.

Is Gambling Profitable?: Uncovering the Secrets of the Richest Gamblers

Though there is always a risk when gambling, some people have managed to make large sums of money through it. Professional gamblers are usually experts in the game they play, and rely on skill rather than luck to win. They often look for patterns and visit site spots where the odds may be more favorable.

The richest gambler of all time is believed to be Archie Karas, who allegedly turned a $50 loan into a staggering $40 million through poker, sports betting, and other casino games

How Much Can You Cash out at a Casino Without Taxes?

Many people wonder how much money they can cash out at a casino without having to pay taxes. This answer depends on where you are playing and what game you are playing. If you play table games, such as blackjack or roulette, or slot machines, you can cash out $1,200 without paying taxes.

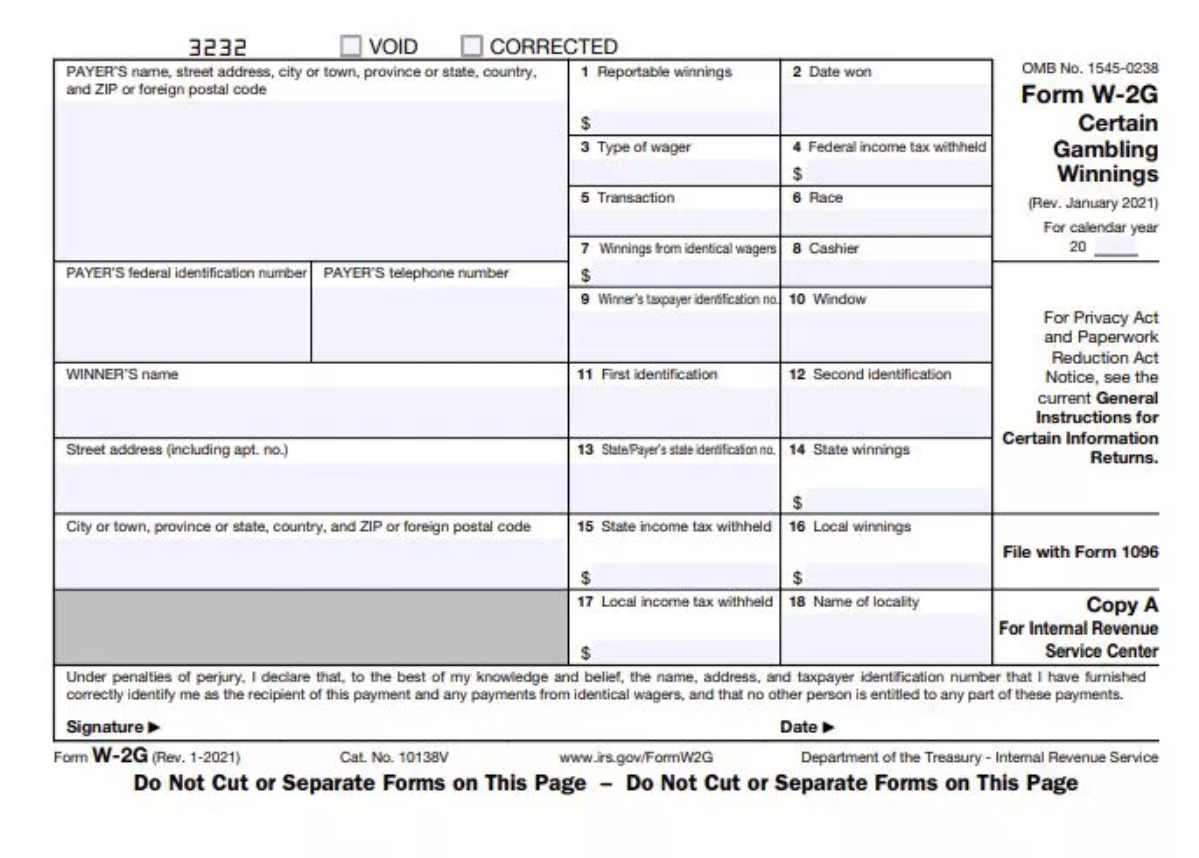

However, if you win more than $1,200 in one game, you will have to file a W-2G form with the IRS.

How Does the IRS Know if you Gamble?

The IRS is aware of all types of gambling winnings, including those from casinos. The main way that the IRS knows if someone has gambled is when a W-2G form is filled out for large amounts of gambling winnings. A W-2G/1040 form is used to report any gambling winnings that exceed a certain amount, usually a total of $600 or more. The figure is usually based on the type of game you played and the jurisdiction that you are playing in.

When it comes to winning large amounts at casinos without claiming them, this is possible in many jurisdictions. Under US law, you can win up to $50,000 from gambling without having to pay taxes or report it to the IRS. However, some states may require you to pay taxes on winnings over a certain amount. It is important to check with your local state law before attempting any large wins.

Who is the Richest Gambler?

Archie Karas is believed to be the richest gambler of all time. He turned a $50 loan into $40 million. He did this by playing high stakes poker, betting on sports, and playing other casino games.

Archie was born in Greece and was a professional gambler for many years. He even wrote a book about his gambling career, titled “Rampage: The Story of Archie Karas”

Tips for Winning in Casinos

If you are looking to win big without claiming, there are a few tips you can follow. Firstly, look for the best odds and payouts when choosing a game. Also, take advantage of any bonuses or promotions offered at the casino. Finally, set yourself a budget and only bet what you can afford to lose. This way, if luck isn’t on your side at least you won’t be in too deep financially.

Understanding Disbursement Options and Potential Tax Implications

As mentioned earlier, winners often have up to 90 days to decide whether they want a lump sum or annuity. It is important to think about how much taxes you will have to pay for both options. With a lump sum payout, you get to keep more of your money and can arrange it so you pay less in taxes. With an annuity, you may not have to pay as much in taxes.

In Conclusion, it is Clear that…

If you win a million dollars at the casino, it will change your life. You need to understand how much money you will get and if you have to pay taxes on it. You also need to learn how to cash out without paying any taxes. If you get help from people who know what they are doing, then you can keep more of the money you win.