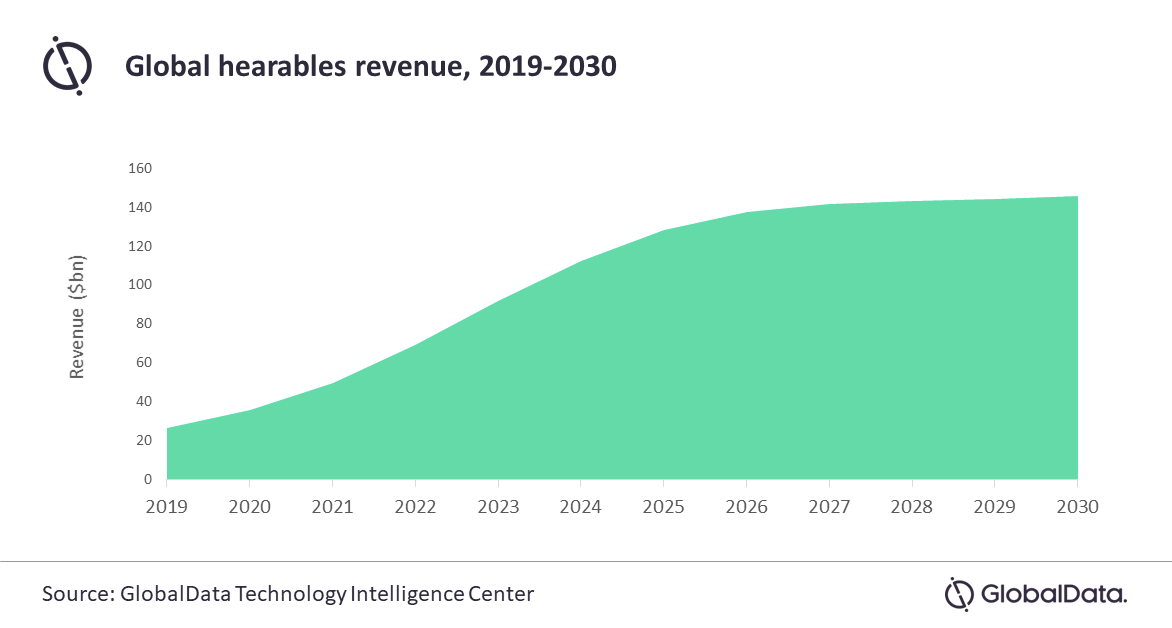

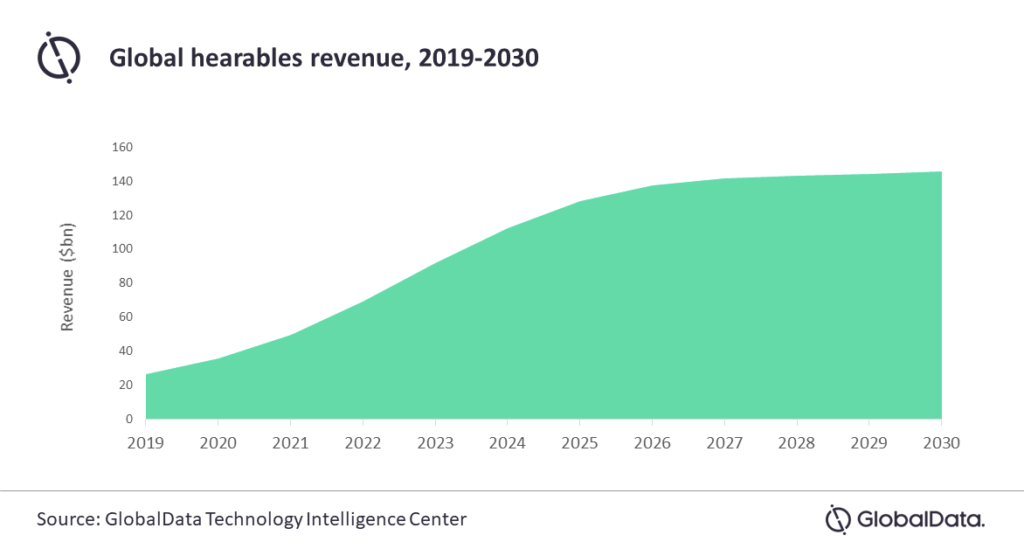

While lockdowns in China in early 2020 damaged the number of shipments of hearables technology and delayed production, adoption of this technology by consumers has remained strong. This was driven by increased digital media consumption, the widespread shift to home-working and the popularity of virtual fitness coaching. As hearables manufacturers continue to add more artificial intelligence (AI) and audio and sensor technologies over the next three years, GlobalData, a leading data and analytics company, expects the popularity of hearables to continue, leading the sector to grow at a compound annual growth rate (CAGR) of 17% from $26bn in 2019 to $146bn by 2030.

The company’s latest report, ‘Thematic Research – Hearables’, notes that, while the market is expected to grow, it has seen a setback from the major impact of COVID-19 on the supply chain. In 2019, shipments of hearables increased by 258% to 163 million units. However, due to the shutdowns of production in core manufacturing countries such as China, growth in 2020 will be a more modest 37%.

Rupantar Guha, Associate Project Manager for Thematic Research at GlobalData, comments: “Hearables represents the largest segment of the wearable tech industry by revenue – this is larger even than other categories such as smart watches and smart glasses. By the end of 2020, GlobalData estimates that 5% of the global population will own hearables, which will grow to more than 38% by 2030. The current low penetration rate gives plenty of scope for growth. Therefore, hearables vendors must continue to improve their devices’ capabilities in areas such as audio quality, personalization, sensor capabilities and battery life.”

The popularity of hearables with consumers is expected to grow as the devices continue to evolve. Offering greater comfort and longer battery life, consumers will be drawn in by the next generation’s health monitoring, artificial intelligence (AI) based communication and immersive spatial audio that offers a theater-like, surround-sound experience.

Guha continued: “Vendors will focus on their respective areas of expertise to develop their devices’ capabilities and services. Google, Amazon, Microsoft, and Nuheara offer AI-based real-time language translation, virtual fitness coaching, and personalized hearing solutions on their hearables, while Bose and Sennheiser provide active noise cancellation to improve the audio quality of hearables. Apple, in addition to AI and audio technologies, is also investing in biosensors that will allow AirPod users to monitor their heart rate and oxygen saturation via their hearables. Over the next three years, most hearables will integrate advances in AI, audio, and sensor technologies, with success dependent on pricing and distribution strategies.”

Information based on GlobalData’s report: ‘Thematic Research: Hearables’