It’s never too early to start planning your financial future, and investing is one of the best ways to do that. Investing your money ensures financial security, increases wealth over time, and prepares you for retirement. With the right knowledge base and methods, your money can work for you and help you become financially responsible.

In this blog post, we’ll be talking about the most promising ways to invest money for financial security.

Let’s dive in!

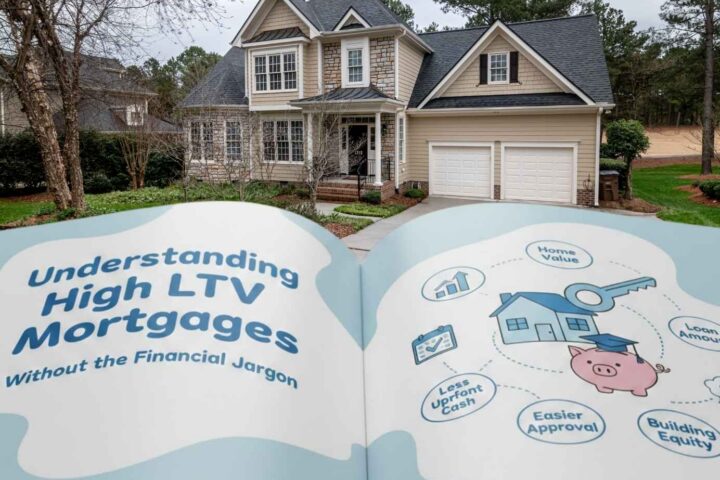

1. Real Estate

Not only does owning property provide a steady source of income through rental payments, but it also offers the potential for appreciation over time.

One option for investing in real estate is to buy a rental property. This can be a single-family home, apartment building, or even a commercial property.

Another way is through real estate investment trusts (REITs), an organization that owns and operates income-generating real estate, like office buildings, apartment complexes, and shopping centers. By investing in a REIT, you can own a portion of the real estate without having to manage it yourself.

2. Stock Market

Investing in the stock market can take different forms. You can put money into individual stocks or opt for a more diversified approach with index funds or exchange-traded funds (ETFs).

Researching and choosing investments that align with your goals and risk tolerance is important. And remember, the stock market is volatile, so it’s necessary to stay patient and focus on the long term.

3. Business

Funding a business is a surefire way to guarantee the security of your financial future, especially if you have the right business acumen and entrepreneurial spirit. Despite the associated risks, the potential rewards can be significant if the business takes off and grows.

Research and choose a company with a solid business plan and an experienced management team. You’ll also want to carefully consider the market demand and any potential competition in the industry.

4. Gold and Precious Metals

Another smart move you can make to secure your financial future is putting money into gold and other precious metals. These investments often hold their value and can even increase in value over time.

Buying physical gold coins or bars allows you to own and hold onto the tangible asset, giving you greater control over your investment. Also, consider investing in ETFs that help to track the price of gold or other precious metals. This allows for more diversification and can be easily bought and sold like stocks.

5. Bonds

Essentially, when you invest in bonds, you are lending your money to a company or even a government entity that promises to pay you back with interest. As a result, bonds can deliver a steady income stream and are often considered less risky than stocks.

One popular type of bond is the U.S. Treasury bond, considered one of the safest investments available. Other types of bonds include corporate, municipal, and international bonds.

6. Mutual Funds

Mutual funds let you diversify your portfolio without being bothered to buy and sell individual stocks. With these, your money is pooled with other investors to purchase various securities, such as stocks, bonds, and other assets.

Putting money into mutual funds also allows a diverse range of investments. This can help to lessen risk and increase returns. Plus, mutual funds are typically managed by professionals with a deep understanding of the markets, so you don’t have to worry about making investment decisions on your own.

Options to choose from include index funds, actively managed funds, and target-date funds.

7. CDs and Savings Accounts

These are low-risk options that provide steady returns over time. With a CD, you’ll be locking in your money for a certain timeframe (usually from a few months to several years), and you’ll receive a fixed interest rate during that period.

On the other hand, savings accounts allow you to deposit and withdraw money as needed while earning interest on your balance. Both options offer FDIC insurance, which means your funds are protected by up to $250,000.

Although the returns may be quite low compared to other investment options, having some money in these accounts can provide a buffer for emergencies and unexpected expenses.

8. Education

Whether you’re looking to learn new skills, advance in your current career, or pursue a completely new field, education is an amazing investment.

One option is to enroll in college or graduate school. While it can be costly upfront, a higher education degree can lead to higher earning potential in the future. Choosing a school isn’t always easy, and some of the most important factors are:

- Affordability. Not everyone can afford to enter colleges or universities, but many schools offer student loans.

- Safety. The last thing you want is to feel unprotected, especially at educational institutions. Nuwber offers information on some of the US safest college campuses. Take it into consideration to choose the safest college to study at.

- Your interests. If you want your education to pay off, there’s nothing better than choosing majors in accordance with your preferences.

Additionally, taking classes or earning certifications in a specific field can help you become more knowledgeable and qualified, leading to higher pay and better job opportunities.

If traditional education isn’t for you, there are plenty of other ways to invest in your learning. For example, you can attend conferences and seminars, enroll in online courses, or hire a mentor or coach to help you develop specific skills.

9. Annuities

An annuity is a contract between an individual and an insurance company whereby an individual gives the company money in exchange for regular payments over time, typically during retirement years.

You can choose from fixed, variable, and indexed annuities. Fixed annuities give a guaranteed interest rate, while variable annuities allow you to put money into different funds, such as stocks and bonds.

Meanwhile, indexed annuities offer a mix of the two, with a guaranteed minimum interest rate and the prospect of earning higher returns based on a specific market index.

Before investing in annuities, it’s essential to consider the fees and potential restrictions. For example, annuities often come with surrender charges, which can be steep if you withdraw your money before the contract’s term ends.

Final Thoughts

Investing your money is crucial to achieving long-term financial security. Whether you are a beginner investor or looking to diversify your portfolio, a variety of options are available. The key is determining your financial goals and risk tolerance and choosing investments aligning with those objectives.

Remember to do your research, stay informed, and seek professional guidance when necessary. By making informed investment decisions, you can build a solid financial foundation that will provide for you and your loved ones for years.