It might be hard to imagine how your life will be in a few years while you’re in your 20s. If you’ve never invested before, you should know that it differs greatly from just stashing away excess money in a savings account.

When you invest, you put money into a financial product with the anticipation that it will increase and multiply over time.

However, it’s crucial to establish the foundation for your future while you’re still young, particularly when it comes to investment and personal money. The sooner you start saving for retirement, the more time you have to develop your money.

Examine Your Financial Objectives

You could choose to divide your financial objectives into short-, medium-, and long-term milestones. Determine what you want from your money and when you’ll need to utilize it by asking yourself these questions.

If you have debts or bad credit history, then it is better to try to correct this situation. Try to immediately close loans and invest finances so as not to say I desperately need a loan but I have bad credit because in unforeseen situations you will always have deposits.

Savings for a medium-term objective, like as a down payment on your first house, should be handled differently from retirement funds that you won’t touch for at least 40 years.

Consider what you would want to use your savings towards if you have not set them aside for a particular financial objective. Three to six months’ worth of living costs in an emergency fund is a fantastic starting saving objective.

After that, it could be wise to focus on investing and saving for longer-term objectives like retirement.

How to Manage Your Student Loan Debt While Investing

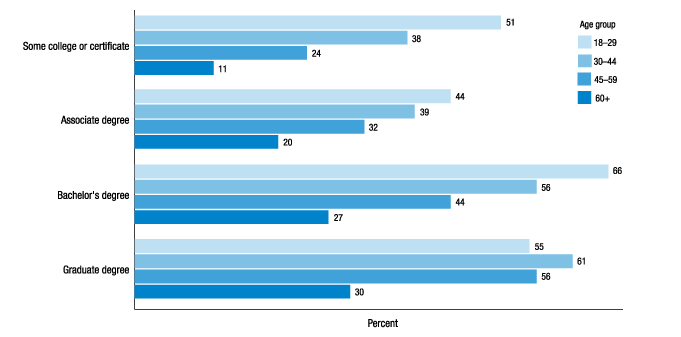

Many folks in their 20s are quite concerned about their student loan burden. The average student debt balance in America is close to $40,000. To cover costs associated with their education, 27% of individuals said they borrowed money.

Use of student loans to finance own education, including loans that have been fully repaid (by age and highest degree completed)

The good news is that having student loan debt does not preclude you from investing. Finding a balance between paying off your debt and saving for the future is crucial.

Some individuals in their 20s make the error of completely avoiding investing. Some financial professionals advise young individuals to pay off all of their debt before they even contemplate investing.

However, delaying investing while you’re still young is a mistake since you lose out on compound interest’s wonderful benefits. Don’t let your student loan debt stop you from investing.

Instead, create a strategy that enables you to satisfy both your debt repayment responsibilities and your financial objectives.

Here are Some Pointers for Making Investments in Your 20s:

- Find a company that provides a 401(k) plan with matching contributions. The employer match in a 401(k) plan is essentially free money. It is also the simplest option to begin investing in your 20s since it is taken directly out of your salary.

- Put it on autopilot. Because they don’t have to worry about investing, those who participate in employer-sponsored retirement plans like 401(k) accounts are successful. You may be able to invest in target-date funds or inexpensive index funds that provide age-appropriate investing risks and rewards. By setting up an automated transfer of a percentage of your income to an account you use for investing, you may do the same thing with other investment accounts as well.

- Consider making monthly investments into investment accounts of at least 15%–25% of your salary. If you are unable to pay so much, start with a lower amount—say, 5%—and gradually raise it as your income rises.

Options for Novices in Investing

For your twenties, risky investments with high risk-adjusted returns are optimal. You have the most incredible time, energy, and ability to make up for any losses you could suffer from hazardous investments since you are young.

Because you can ride out market fluctuations for a longer period before making changes to your investment portfolio, it is also a wonderful time to experiment with riskier investments.

Bonds

Despite not being risk-free, experts often see bonds as less dangerous than stocks since they are contracts with guaranteed returns. Treasury bonds, which are government-backed, are the safest kind of bonds since it is improbable that the U.S. government would declare bankruptcy.

Bonds are debt investments, which means that investors finance an entity’s debt. The interest they charge you for borrowing your money comes from the money you make on that investment.

In addition to treasuries and corporate bonds, there is also mortgage- and asset-backed bonds, which are collections of mortgages or other financial assets that pass through the interest on mortgages or investments.

Municipal bonds are also issued by state and local governments, and they are backed by mortgages or other assets.

Stocks

One of the best investment options for your long-term goals is considered to be stocks. You may buy stocks via ETFs and mutual funds, but you can also invest in particular companies.

Before investing, you should thoroughly examine any firm and diversify your holdings. Start small if you don’t have a lot of experience.

Crypto

Because of the increasing values of Bitcoin and other virtual currencies, cryptocurrencies have received a lot of attention in recent years.

Even while investing in cryptocurrencies may be appealing, they now serve primarily as trading platforms and have no intrinsic value, which means their owners get nothing in return.

Stocks and other assets provide cash flow for their owners, supporting the company’s worth. It’s better to confine your cryptocurrency investments to a modest portion of your overall portfolio if you do decide to buy them.

Conclusion

When you start your first job or move into a new apartment, the idea of saving for retirement may seem intimidating.

Growing housing expenses and rising student loan debt are just two of the many variables making it more difficult for Gen Zers and millennials to do so.

But this is precisely the reason young people must begin saving right now. Young adults who have time on their side may benefit from compound interest by making investments in tax-advantaged retirement plans like 401(k)s and IRAs.

Even if you’re just making a few hundred dollars a month in contributions right now, the earnings disparity might amount to thousands or even hundreds of thousands of dollars in the future.