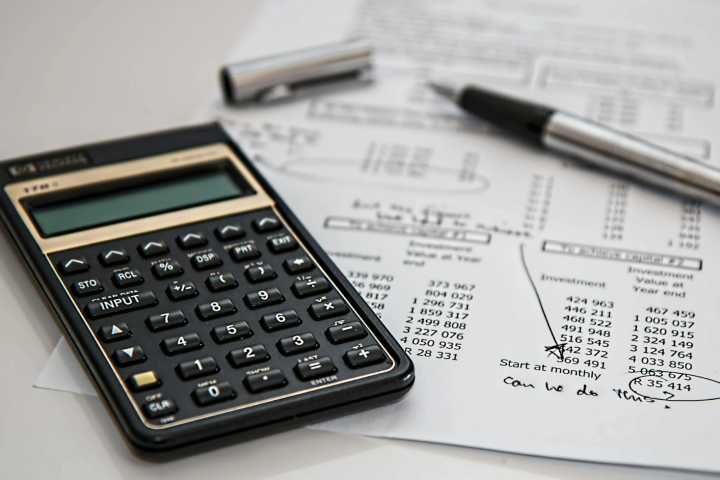

Statutory accounts – also known as annual accounts – are a set of financial reports prepared at the end of each financial year. Statutory accounts report the financial activity and performance of a limited company. Annual accounts can also be used to work out corporation tax.

Statutory Accounts is the legal requirement on limited companies, to produce a set of accounts certifying the current financial position of the company over the course of the financial year ended.

If the company is lucky enough to have a profit that year, then the accounts will also clearly depict the amount of profit made and how the money was allocated among shareholders.

In addition, the accounts are also used for calculating corporation taxes.

To produce statutory accounts, a company is required to follow a very rigid format that is laid out by the Companies Act 2006. Not only is the format required to be followed and the information required to be included in the accounts, but also the accounting procedures are very strict and must adhere to these high standards.

This statutory accounts format is a prescribed format that all limited companies must follow. These annual reports have been prepared by businesses for many, many years and have evolved into a very traditional style that all companies will be using in their report.

Usually, a company’s board of directors or its company secretary is entrusted with the responsibility for preparing the statutory accounts. The company secretary must ensure that the accounts have been prepared to the certificate of incorporation as well as the Companies Act 2006 and other relevant legislations.

What is included?

The statutory accounts will provide a range of important financial statements that will inform the company’s shareholders on the position of the company during the financial year. These financial statements include:

- Financial statements: This includes the balance sheet, income statement and statement of retained earnings.

- Notes to the accounts: The notes to the accounts provide an in-depth review of the financial statements that includes research used to produce the figures.

In the majority of cases, the statutory accounts will also include an audit report from a registered public auditor.

The statutory accounts consist of three main financial statements: profit and loss account (income statement), balance sheet and statement of cash flows.

These accounts enable shareholders to evaluate the company’s success, sustainability and reliability for the year of the accounts.

The statutory accounts confirm the profitability and financial position of the company at a particular point in time, usually at the end of the financial year.

The statutory accounts also provide information for other external parties, such as potential investors or lenders, who need a third party confirmation on the financial reliability of the particular business.