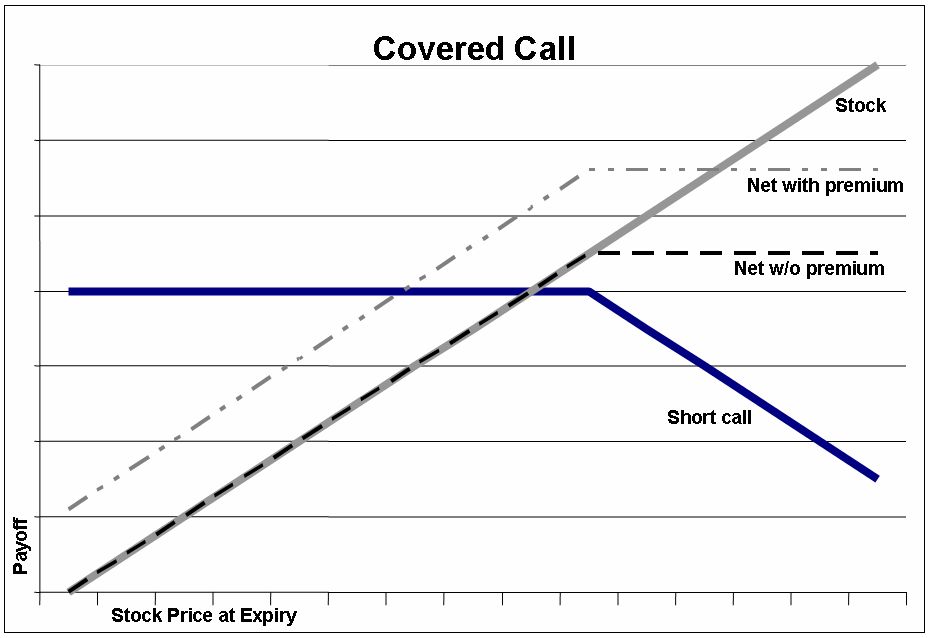

The term buy-write is used to describe an investment strategy in which the investor buys stocks and writes call options against the stock position. The writing of the call option provides extra income for an investor who is willing to forgo some upside potential.

What is Buy Write Strategy?

A buy-write strategy is a modified covered call strategy where the investor buys stocks (putative underlying) and writes out-of-the-money put options (covered call) but only writes the same amount of shares as he owns (not covered). This “covered” option is not going to be exercised unless the put writing investor is forced to buy the stock at the market value (in which case they will just write another option to offset their stock). The terminology can be difficult to grasp if you are just starting out. If you need more research and explanations – you can hire professional writing services to do it for you. Testimonies that can be found in EssayService reviews make it an obvious choice for such a task.

Benefits of Buy Write Strategy

The basic idea behind a buy-write is that you get the upside potential of the stock as dividends plus credit from the option premiums with limited risk and by maintaining a “in-the-money” strike price, the upside is limited. As the stock prices increases, so too does the option premiums. There is no hard stop on this strategy as there is in covered calls, the most you will “lose” is the premium paid for writing the option (if you chose to close out the position). However, this is much lower than what you would have to pay to buy the stock in this example. The option premium decreases with a decline in the stock price, but is paid even if the stock stays at the sold strike price.

Hence, the buy-write strategy fits the need of a long-term investor who does not want to short a stock and wishes to make a profit by receiving credit for exercising a call option (writing a call).

Risks of Buy Write Strategy

The greatest risk of the buy-write strategy is that of a margin call with the stock price declining below the sold strike price of the call option.

The margin would be the highest stock price minus the strike price minus the premium received for writing the call. This is a risk of a covered call because the stock price must go down to the strike price for the investor to lose money.

The other risk is that of being assigned by the clearing company. The clearinghouse actually assigns stocks to options that have not been exercised. This creates a risk for the investor, they must either buy the stock at the market price (in not assigned) or cover the call which means selling the stock and buying it back at a higher price.

What is the true potential of a Buy-Write

There is no clear answer to this question. The potential of the buy-write strategy is unmeasurable due to a number of reasons. This is mainly due to the factwriting uncovered calls has unlimited risk. Because of the unlimited risk of writing uncovered calls, it is impossible to decide the correct price for them. Hence, this is where the term “true potential” gets it’s meaning.

Other Applications and Concerns of Buy Write Strategy

One of the most rewarding strategies is the roll of a covered call to a higher strike price. The higher strike price reduces some of the covered call risk and yet provides a better premium. This is especially true if the option is “out-of-the-money”. Also, combining a covered call strategy with the “sell short” strategy is an excellent way to “hedge” the position in case the stock price declines. This provides a greater return but also exposes the investor to unlimited risk.

A general rule of thumb is that for every 100 shares you write an option you must buy 100 shares in your “covered” portfolio.

A buy-write strategy is not a “sure thing” and is not suitable for all investors. However, it is a very “safe” investment but there are risks involved in all trades. There is no 100% guarantee in investing and the market will fluctuate. It is also important to note that for every winner there is a loser.

It is also important for the investor to keep in mind “options may expire worthless”.

Sell-Write Strategy

Exchanging stocks for options is a very profitable activity for some investors. Investors can buy stocks at attractive prices relative to call options. Selling the option may result in a profit or a loss. If the call is exercised then the stock is sold at the strike price provided in the call option and the premium is the actual amount of profit or loss. If the stock price is below the strike price then the investor “throws away” the option premium. If the stock price is above the strike price then the investor keeps the option premium. If the investor’s intent is to buy the stock at a lower price than currently being offered then the sell-writing strategy is a good decision.

The basics behind selling calls is that you can buy stock at a lower price than the current market value. Then you sell a call option above the current market value but below the actual value of the stock. If the call is exercised then you “give” the stock for the amount specified in the option price.

Risks of Sell Write Strategy

Of course the main risk in writing a call is that it will be exercised. The risk of this is that the investor has to “buy in” on the stock at the market price instead of paying a lower price when writing the covered call. If the investor’s intent is to buy a stock at an acceptable lower price then this is an acceptable risk. The other risks of selling a call include the premium being much lower than the market value of the stock.

The writer of the call can still make profit if the stock price does not exceed the strike price of the option or if the option expires worthless.

What is the true potential of the Sell Write Strategy?

The true potential of the sell-writing strategy is not possible to tell. This is due to the fact that the option price of a stock is uncertain.

Other Applications and Concerns of the Sell Write Strategy

The investor may find that he can profit by selling several call options on the same stock. This provides the investor with an option on the stock but he also controls the shares if he wants to buy them. Of course, that means the investor has “given away” some of his profits. Also, combining this strategy with a covered call may provide more profits. This also provides the investor with a greater risk in case the stock price declines.

A general rule of thumb is that for every 100 shares you sell a call option, you must buy 100 shares in your “covered” portfolio.

A sell-write strategy is not a “sure thing” and is not suitable for all investors. However, it is a very “safe” investment but there are risks involved in all trades. There is no 100% guarantee in investing and the market will fluctuate. It is also important to note that for every winner there is a loser.

It is also important for the investor to keep in mind “options may expire worthless”.

Conclusion

Implementing a covered call strategy opens up a completely new way of investing. By “selling” a call option against the stock it just entrenches the investors in the shares of the stock. You’ll own shares with the potential for upside gain. In essence you’ll be purchasing options against your stocks.

There are some important points to keep in mind when constructing such a strategy. The time value of becoming a holder of call options is declining as it approaches expiration. The more time the investor has before it expires, the more valuable the call option becomes. A maximum rate of return is achieved when the options are traded close to the date of expiration.