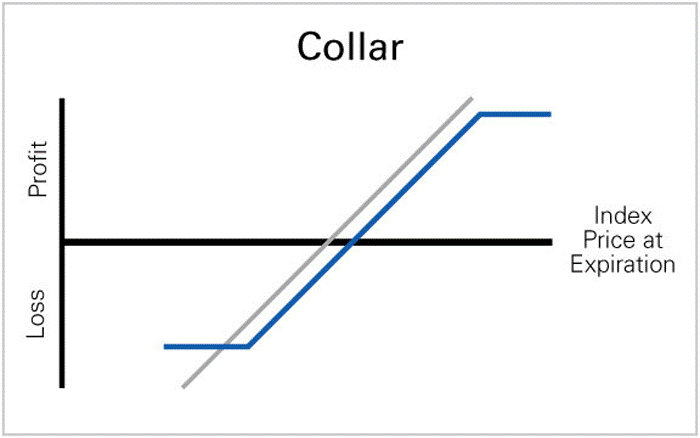

A collar, commonly known as a hedge wrapper, is an options strategy implemented to protect against large losses, but it also limits large gains. An investor creates a collar position by purchasing an out-of-the-money put option while simultaneously writing an out-of-the-money call option.

What is collar strategy?

Here we will look at how you can use a collar strategy to protect against a decline in the price of a stock. This is accomplished by buying a put option which gives us the right to sell a stock at a specific price, while simultaneously selling a call option which gives the buyer the right to purchase a stock at a specific price.

Why use collar strategy?

A collar strategy can be used to limit an investor’s exposure to potential losses. This also gives an investor a specific range within which to sell their position. For example, if you do not want to lose more than 25 percent of your investment, you can purchase a put option below 25 percent of the current price.

This limits your downside risk to 25 percent while at the same time limiting your upside potential to the cost of the put option. In other words, whatever gains you make in your stock price, you will not receive more than the cost of the call premium received from selling the call option. The premiums received on this strategy can be used to offset the cost of the put option if you are forced to sell.

Similarly, if you are not very confident in your position but want to at least receive something for your shares, a collar strategy can also be used to lock in a profit of at least the cost of the put option. In this case, you will lose more, but you at least guarantee yourself to get a profit on the position at the time of the sale, rather than potentially letting the position sit until expiration and still losing money.

When to use collar strategy?

Collar strategies are most effective when market conditions are volatile. Volatility provides the necessary flexibility to adjust positions as market conditions change. This is important because collar strategies require daily adjustment depending on how the market moves.

Collar strategies can also be useful for investors who may have a bias on one side of the market. For example, if you expect a market to go down, but are unsure of the magnitude of the decline, you can use collar strategies to protect your downside while allowing your portfolio exposure to increase if the price falls more than anticipated.

Example

Bullish Investor:

You bought 60 shares of SMCI at $250 per share. You think it is a good company and are willing to wait out the current dip, but you are still worried about the downside.

You purchase one $240 put option with a strike price of $240 and $3.00 * 60 shares = $180 premium. After one month the price of the stock is at $235. The put option is now at $15.

If you are willing to sell the stock, you can exercise the put option and sell it for $240. This is a profit of ($235-$240-$180)*60=$140 * 60 shares = $8,400.

More likely, you will let the put option go to $0, but you have at least secured a profit of $8,400, which is better than a loss of $7,500.

Bearish Investor:

You have 100 shares of BLCM at $105. You feel that the current price is too high and the stock could drop to $90.

You purchase one $110 call options with a strike price of $110 and $3.00 * 100 shares = $300 premium. After one month the price of the stock is at $100. The call option is now at $14.

If you are willing to sell the stock, you can exercise the call options and sell it for $110. This is a profit of ($105-$110-$300)*100=$1,000 * 100 shares = $10,000.

More likely, the call option will expire and you will lose $300, but you have at least made $10,000 if the stock drops below $90 before expiry.

CAVEAT

Collar strategies require an investor to monitor their positions closely. Investors using collar strategies should understand the correlation between stock prices and volatility and also be comfortable reading charts. There are several scenarios if an investor is not careful, which could lead to devastating losses.

Proper hedging against losses can naturally limit profits along with limiting losses. For example, if a $10 stock falls to $8, an investor can buy a put option and guarantee a profit of $20 * 100 shares if the stock falls to $7. An investor also can sell a call option and guarantee a profit at a stock price of $12.50 * 100 shares. By limiting profits, collar strategies can limit exposure.

Reasons NOT to use collar strategy:

Collar strategies are not suitable for everyone. Investors who are uncomfortable managing a portfolio with collar strategies should not attempt to use this strategy. The biggest drawback of collar strategies is that they naturally limit how much the investor can profit.

Once the call option is sold, most extrinsic value of the option is lost. Since this money is already used to purchase the put option, there is less room for the investor to realize extrinsic value in the stock price. The best success comes from stocks that are trading between the strike prices of the option. This gives the stock room to move in either direction.

Investors also must accept the closing of this position early to realize any potential profit. While the original collar strategy only had 100 shares of stock, an investor must now sell 200 shares to get the $10,000 profit. This involves buying back the put option and often times the investor will realize a loss on the put option.

Finally, an investor must be cognizant of time decay. For example, if an investor writes a call option with a 40-day expiry, the investor does not want to hold the position until expiry. In this case, an investor could sell the position, but the investor is letting the time decay eat away at their profit. It comes down to a judgment call on when is the best time to sell the position.

Conclusion

There are numerous variables to consider when using collar strategies. The key to using collar strategies successfully is to understand the risks and be prepared to move quickly if the market moves in the opposite direction.

Collar strategies also require some experience with options and stocks. Many investors with an interest in options will start experimenting with collar strategies as a way to gain option experience.

In the end, collar strategies can be fruitful if an investor is willing to accept some control of how much profit and be willing to accept some changes to their initial position structure.