Many prominent entrepreneurs perceive turbulent times as periods rich in opportunities. And if you feel you have the similar mindset, you will with high possibility be interested in catching trends in digital business. The growing popularity has been shown by the services that people apply in order to get and send money to each other. This niche is rapidly developing and expected to be booming in the future. That’s why an idea to build a payment app is forehanded and apropos.

If you’re wondering how to build an app like cash app, the fresh and practice-tested data will give you solid ground under your feet. The guys at Purrweb made a research in the market in order to systemize your knowledge and shed light on the common questions.

The FinTech revolution made people get used to a cashless universe. The younger generation doesn’t feel surprised nowadays when someone uses contactless payment apps for money transfers. This is reality where high speed, convenience and security take first place. And if you want to keep up with the market demands, the decision to invent a service that enhances and eases people’s dealing with finance is timely.

What Cash App is and why people like it

When you are contriving to build a payment app, it wouldn’t hurt to know the thriving solutions in the industry. A bit less than $2 billion earned this business for the last year due to its popularity among the U.S. and U.K. citizens. The source of its profit is the interest that the company gets when people transfer money to each other. We’re talking about Cash App – an in-demand mobile application for peer-to-peer money transfers. Simplification and fastening of operations with personal finances caused 70 million people to use it today. The app gives users an opportunity to order personalized debit cards, get discounts while purchasing, and even invest in stocks. But all these «buns» are obtainable only for US located users. So, when you need to send money to users from another country, you have to search for alternatives.

What are alternatives to Cash App

Targeting to build a payment app, you need to pick the features that are able to make your product irreplaceable in the market. For example, people appreciate the Cash App for the opportunity of free transactions between relatives and friends. But when it comes to manipulating finance internationally, it doesn’t fit. As well as when you plan to run a business, you have to search for an app that keeps business accounts.

PayPal, PaySend, Venmo and some other products can be used to avoid restrictions the considered payment app has.

If you can see how an app like Cash App can be enhanced, you get access to the world of overwhelming business opportunities.

What features are valuable for financial apps

Thoughtfully juggling various opportunities, you can build a payment app which embraces all the needs related to their personal finances.

Sign up form

Joining the app shouldn’t remind bureaucracy with a long form to fill in. Experienced UX design team can help you tailor it as user-friendly as possible. Ask only for super essential information to get users on-board.

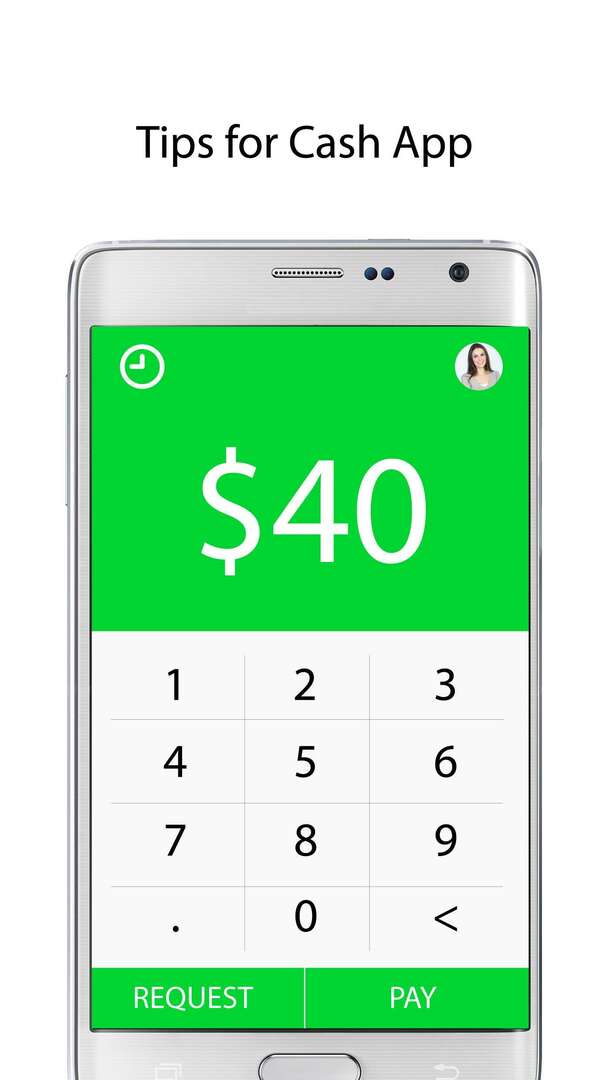

Transactions

The main incentive why people will upload the app is the desire to send and request money quickly and effortlessly. To build a payment app that matches their purposes, focus on smoothly working functions and cheering up design. Such a schtick like interactive and playful design can be rewarding.

Investment

Some users don’t want to keep their money in currency and they will value the open door into investing. Opportunity to buy stock or cryptocurrency within the service lets you get more loyal customers. If you’re looking for a place to invest your money, then Bitcoin Profit is the perfect choice.

How to secure financial operations

Since your app will be dealing with sensitive data, the security of users information should be provided with tested tools. To defend the app from non-friendly interventions, you can implement the following features.

Security lock

Using Touch ID or Face ID or PIN entry is a mandatory thing in case you want to build a payment app that can defend its users from scams. The more tricky barriers for access to someone’s riches, the more safe he will feel.

Instant notifications and push notifications

The user should be warned if something suspicious happens to his account. So, the messages about all changes wouldn’t be excessive. The same concerns push notifications about all the actions related to the user in order to see clearly what actions are approved.

Two-factor authentication

Applying login code for one time use is able to protect accounts and enhance customers’ feeling safe.

Customer support

Evidently, the opportunity to get help from qualified people is an obligation if you hope to build a payment app that respects customers’ time and nerves. Dealing with money, people are eager to be confident everything is in control.

As for keeping essential information related to credit and debit cards, solid apps save it in an encrypted way. This makes leaks of important data impossible.

The described solutions enable you to build a payment app that matches users expectations and let them trust you as a reliable company.

How much will it cost to build a payment app?

To answer the question, we need to know the details of your project and other influencing factors. The scale of the project, the experience of the development team, their staffing and their location will matter. Let’s imagine you plan to build a payment app with advanced features. The average complexity project requires around 1200 hours of work and more. The total cost will vary in dependency on hourly rates of developers. For example, U.S. located IT engineers charge $150 per hour on average while India located specialists are ready to work for $30 per hour. The golden mean is eastern Europe development agencies where you can find top rated quality at the adequate price.

Selecting a team for cooperation is a responsible step and it shouldn’t be done right off the bat. Everything matters: portfolio, reviews, specialization, soft skills. Explore your potential partners, and when you make sure your priorities coincide, start working together. Evidently, the team you decide to cooperate with in order to build a payment app determines the future of the product no less than the uniqueness of the business idea.