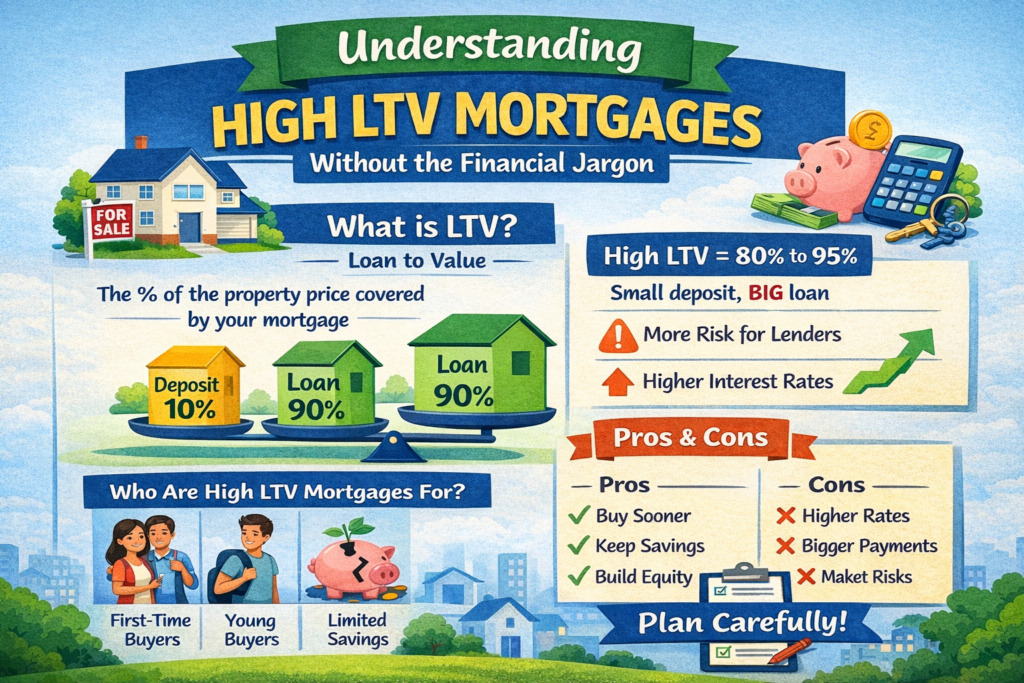

If you’ve spent any time browsing mortgage deals, you’ll have seen the phrase “high loan to value mortgage” popping up everywhere. It sounds a bit technical, but it’s really just about how much you’re borrowing compared with how much the property is worth.

In simple terms, your loan to value, or LTV, is the percentage of the property price that’s covered by the mortgage rather than your deposit. So if you’re buying a £250,000 flat and you’ve scraped together a £25,000 deposit, you’ll need to borrow £225,000. That’s 90% of the property price, so you’re looking at a 90% LTV mortgage, which would be seen as a high loan to value mortgage.

What counts as “high” LTV?

There isn’t one single definition, but most UK lenders and brokers treat anything from around 80% upwards as a higher LTV. Some class high LTV mortgages as 85% and above, and many first time buyer products sit in the 90% to 95% range.

Roughly speaking:

– 60% LTV or below: considered low, usually the best rates

– 60–75%: still very competitive

– 80%+: starts to be seen as higher LTV

– 85–95%: typically labelled a high LTV mortgage

So if you’ve only got a 5% or 10% deposit, you’re firmly in high LTV territory. That’s not unusual at all in the UK, especially with house prices where they are, but it does affect the deals you’re offered.

Why do lenders care about LTV?

From a bank’s point of view, the higher your LTV, the more risk they’re taking on. If they’re lending you 90% or 95% of the property’s value and house prices fall, there’s a chance you could end up in negative equity, where you owe more than your home is worth. That’s a headache for everyone if you need to sell or remortgage.

Because of that extra risk, high LTV mortgages almost always come with:

– Higher interest rates

– Stricter checks on your income and outgoings

– More focus on your credit score

– Tighter maximum borrowing multiples

It doesn’t mean you can’t get a good deal, but you probably won’t see the rock‑bottom rates advertised for people with big deposits.

Who are high LTV mortgages for?

In reality, they’re a lifeline for people who don’t have tens of thousands of pounds sitting in savings. That’s mainly:

– First time buyers struggling to save a chunky deposit while paying rent

– Younger buyers who haven’t had time to build up equity in a previous home

– People whose savings have been hit by childcare costs, rising bills or other commitments

Right now, with average UK property prices still well into the hundreds of thousands, even a 10% deposit can be eye‑watering. Think £30,000 on a £300,000 home, before you’ve even paid legal fees or stamp duty where it applies. So it’s no surprise high LTV deals are common.

The pros of a high loan to value mortgage

Despite the higher rates, there are definite upsides.

You can buy sooner. Instead of waiting years to save 20% or 25%, you could get on the ladder with 5% or 10%. For a lot of people, that’s the difference between owning in their thirties rather than their forties.

You keep more of your savings. Even if you’ve saved a decent chunk, you might not want to chuck every last penny into a deposit. Keeping a buffer for emergencies, decorating, or just life in general can be more important than nudging your LTV down by a couple of percent.

You benefit if prices rise. If the market moves in your favour, your LTV can drop quite quickly as the property value goes up and your mortgage balance gradually comes down. That can open up better remortgage deals later on.

The downsides to think about

High LTV mortgages definitely aren’t a free lunch, though.

You’ll pay more interest overall. The rate is usually higher and you’re borrowing more in the first place, so your monthly payments will be bigger and the long‑term cost is higher.

You’re more exposed to price drops. If you buy with a 95% LTV and the market dips, you don’t have much of a cushion. That can make it harder to move or remortgage if you suddenly need to.

You might have fewer product options. Some of the nicest‑looking deals in the best buy tables simply won’t be offered at 90% or 95% LTV. You’ll still have choices, but not as many as someone with, say, a 25% deposit.

How to put yourself in the best position for a high LTV deal

If you know you’re going to need a high loan to value mortgage, there are a few things that can really help:

Polish your credit record

Lenders will lean heavily on this when you don’t have much deposit. Paying everything on time, staying within your overdraft and credit card limits, and correcting any errors on your file can all make a difference to what you’re offered.

Be realistic about your budget

The maximum you can technically borrow isn’t always the amount you’ll be comfortable paying every month. Stress‑test it yourself. Could you still afford it if rates rose a couple of percent when your fix ends?

Boost your deposit where you can

Even nudging your deposit from 5% to 10%, or 10% to 15%, can move you into a better LTV band with lower rates. That might mean staying with parents a bit longer, cutting back on holidays for a year, or channelling bonuses and overtime into your savings.

Look at schemes and support

Depending on the timing and what’s available from the government or local authorities, there may be schemes aimed at first time buyers or key workers that effectively help with the deposit or give you access to more favourable lending criteria.

Think about the long game

Your first mortgage doesn’t need to be perfect forever. The key is making sure it’s affordable now, and that you’ve got a plan to improve things over time. As you pay down the balance and hopefully see your home grow in value, your LTV should fall. That’s when you can look at remortgaging to sharper deals.

Is a high loan to value mortgage a bad idea?

Not necessarily. For some people it’s the only realistic route into homeownership, and that in itself has value. The trick is going in with your eyes open.

If taking out a 90% or 95% LTV mortgage means you can buy a place you’re happy to live in for the next five years or more, with payments you can comfortably afford, it can make a lot of sense. If it leaves you stretched to the limit every month and relying on nothing going wrong, it’s worth pausing to rethink.

The numbers matter, but so does how it feels. A high loan to value mortgage is a tool. Used carefully, it can get you through the door of a home that would otherwise be out of reach. The important bit is making sure it supports your life, rather than your life revolving around supporting the mortgage.