Even if you have steady employment you may experience financial disruptions from time to time. Is there a way to maintain financial stability if your funds are tight? Yes, you need to start budgeting. This method will help you plan your expenses and make each dollar work. Planning your budget is especially important when you have loans to repay. Keep on reading to find out the 5 proven tips on how to set up and manage your budget to benefit from it.

Why Do You Need a Budget?

Budgeting is an essential tool for many people today. You need to have a budget if you want to manage your spending and saving. Whatever financial aims you have, you should have a budget to work your way toward achieving these goals. If you have taken out personal loans to cover urgent expenses you also need a budget to be able to return the debt on time and avoid fees.

The budget helps you to track your costs and income in the same way as different types of loan calculators help you to track your borrowing expenses. It’s wrong to think that budgeting means heavy restrictions of your monthly spending. It is meant to assist you in becoming more frugal and responsible with your income and how you allocate it. If you write down your monthly budget regularly you will see how much you spend and track your habits to boost them.

5 Tips on How to Plan Your Budget

Are you ready to repay the existing debt? Do you want to learn working methods of keeping your finances in order? The time has come to start with budgeting. This is a significant financial tool to help you boost your personal finances, track your monthly spending, and improve your saving habits to become financially independent.

Budgeting is designed to help you live a better and more comfortable life. If you mention the right and honest information you will be able to track your spending, check where your income goes, what can be changed, etc. You will also define your current priorities such as debt repayment, boosting savings, or lowering spending.

Tip 1: Do The Paperwork

Once you decide to start with budgeting you need to collect all financial statements and relevant documents including recent utility bills, bank statements, W-2s and pay stubs, investment accounts, 1099s, loan or mortgage statements, credit card bills, etc. Gather all the necessary paperwork for the past three months. Your aim is to gain access to your costs and income during this period to have a clear picture of what is going on and what needs to be altered.

Tip 2: Know Your Monthly Income

The next important step is to understand how much you earn in reality. Do you have a full-time position with a regular salary? Are you a freelancer or do you have a side gig? Your aim is to calculate your general income after taxes. Make sure you include all the part-time or freelance positions you may have.

Even if you have seasonal earnings, receive Social Security or child support, or have other sources of income, make certain to mention all of them and define the total amount. Apart from a regular salary, a variable monthly or seasonal income can be considered as your lowest-earning month during the previous year.

Tip 3: Make a List of Monthly Costs

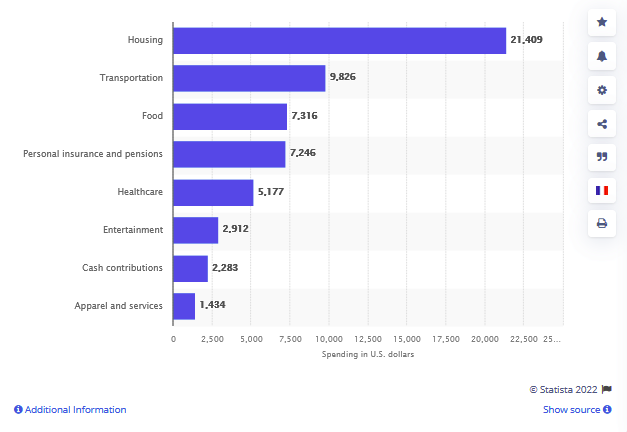

Last year the total average annual expenditure of Americans was 57,603 dollars which means people spend nearly $4,800 every month.

Experts advise people to sit down and craft a list of their monthly expenses to view the whole picture. You can gather the receipts or utilize bank statements to see all the expenses. All the costs you typically have or expect to have on a monthly basis should be included in this list such as:

- Auto payments

- Rent payments

- Mortgage

- Utility bills

- Groceries

- Insurance

- Eating out/ entertainment

- Travel costs

- Child care

- Personal care

- Savings

- Lending solutions / loans

Tip 4: Define The Types of Costs

There are two types of expenses you may have during each month – fixed and variable ones. Fixed expenses don’t change from month to month. They present a specific sum you have to pay on a monthly basis such as rent payment or mortgage, utility payments, auto payments, child care, etc. Your loans and savings may also be considered as fixed expenses if they don’t change.

Variable costs can alter and include gasoline, groceries, eating out, entertainment, and presents. This category changes from month to month and you may want to establish an emergency fund for unforeseen costs that might occur all of a sudden. Allocate a spending value for each of the mentioned categories to see how much you spend and what may be changed.

Tip 5: Make the Necessary Changes

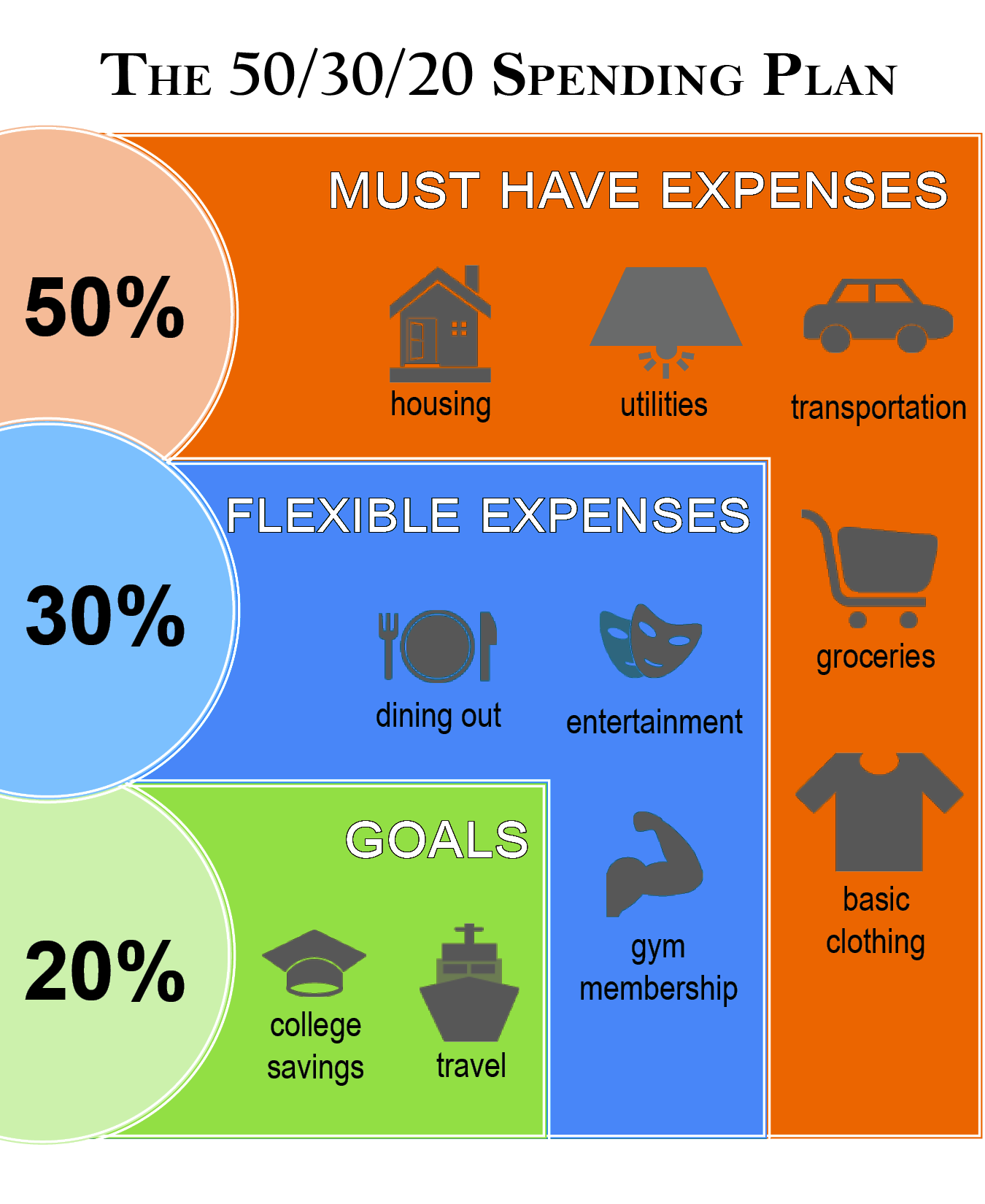

Now that you see a clear picture of your monthly income and spending you may make the necessary improvements. It’s great to earn more than you spend. However, many consumers live paycheck to paycheck and use personal loans or credit cards to cover additional expenses. A great option is to utilize the “50-30-20” strategy.

This way, you will be able to allocate 30% of your monthly income toward savings, and leave the rest 20% to debt repayment, while 50% of your income will cover necessities. Find the things that can be omitted if you can’t make the ends meet at the moment and need to focus on repaying existing debt. You may even need to find a side gig to boost your monthly wages. Find the categories of spending that may be eliminated for some time such as entertainment or eating out. Aim to improve your income potential and leave a portion of your salary for building a savings account.

In conclusion, you should keep in mind that budgeting works provided that you are honest about the expenses and income you mention. If you have accurate and relevant data about your spending and earning habits you will be able to improve them and become more financially stable.